JOIN ME LIVE AT 9 AM ET FOR: TRENDING THURSDAYS

I’ve been watching something unfold in the sentiment data that’s making me think differently about where this market might be headed in the near term — and it’s not what the consensus crowd is expecting.

The University of Michigan sentiment numbers came out recently, and they were terrible. The American Association of Individual Investors (AAII) sentiment surveys?

Equally bad. Everyone and their neighbor seems convinced we’re heading into a recession and a bear market.

But here’s where it gets interesting for me as a trader…

The Contrarian Framework That Changes Everything

When bearish sentiment becomes this widespread and this persistent, something shifts in my thinking. It’s almost like the bearishness is too telegraphed at this point. Everyone expects the crash. Everyone’s positioned for downside. Everyone’s waiting for that shoe to drop.

And that’s precisely when I start getting cautious about being too bearish myself.

Here’s my contrarian framework: I think we’re approaching a point where sentiment gets so exhausted that people just stop being bearish. They’ve been wrong for so long calling for a top that they eventually capitulate.

That’s when the real danger emerges — not for longs, but for bears.

The market’s pain point isn’t always down. Sometimes the most painful move is the one nobody sees coming — a push to highs that people don’t think are real. An everything bubble that extends another 10%, 15%, maybe even 20% higher than where we already are.

I’m not saying this happens overnight. And I’m not basing this on fundamental valuations — I’ll let the technicals tell me when we’ve gone too far.

What I’m Watching to Confirm or Reject This Theory

If we reach conditions where the market becomes ridiculously overbought — I’m talking three-plus standard deviations — or if things like the Buffett indicator push 2.5 to 3 standard deviations above normal, or if we see technical conditions just screaming overbought across the board, then I’ll shift bearish.

But until we reach those extreme technical levels, I’m respecting what the sentiment exhaustion is telling me. Persistent bearish consensus that keeps getting proven wrong has a tendency to fuel continued upside as shorts cover and skeptics finally give in.

This doesn’t mean I’m aggressively chasing every high. I’m still trading with buffers and maintaining risk management discipline. But I’m also not fighting a potential melt-up scenario just because valuations feel extended or because everyone keeps calling for a crash that hasn’t materialized.

Sometimes the market climbs a wall of worry so high that the worry itself becomes the fuel. We might be in one of those environments right now.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Why My No. 1 Weekly Setup Has Been Tagged ‘The Most Reliable’

Over the years, my No. 1 setup for targeting decent windfalls from the market every week has gained a lot of fame.

With traders who have seen it in action calling it the most “reliable trade” in the market.

And although they’re not very far from the truth, it doesn’t mean you’re 100% guaranteed a win on every trade.

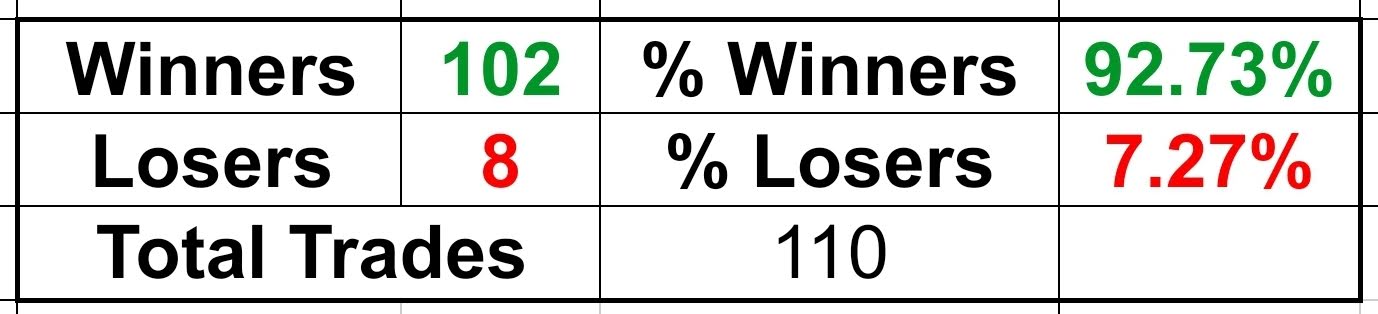

If you take a look here, you’ll see we’ve won 102 trades out of 110… Which means we’ve had a couple that didn’t go our way.

However, the fact that these setups rely on one of the market’s most consistent weekly patterns is what has shot it up the ranks to become one of the safest trades out there.

If you’d let me, I’m willing to show you how this setup came to be, as well as how you can begin deploying it on your own.

Interested?

Then Head Over Here To Get Started

We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading past performance is not indicative of future results. From 9/30/24 – 11/07/25 on live trades the win rate is 92%, 16.5% average return, with an average hold time of 12 days.